Financial Re-finance

The difference between the new and you will old home loan equilibrium is the count that you are credit. You will be able to use that it amount to purchase your house renovations.

Depending on once you re-finance your financial, you can even otherwise may not be recharged charges otherwise charges. If you refinance using your label, your home loan company commonly charge home loan prepayment penalties for breaking their financial. You can end break punishment if you refinance at the bottom of the financial term if it is right up for restoration. For many who re-finance that have various other bank, you will getting recharged a release payment by your newest lender.

A refinance lets you obtain on low mortgage re-finance cost, if you will additionally be restricted to a maximum refinanced home loan off 80% of the residence’s value. Although not, to possess large ideas otherwise building a different sort of home it is possible to thought a home framework financing.

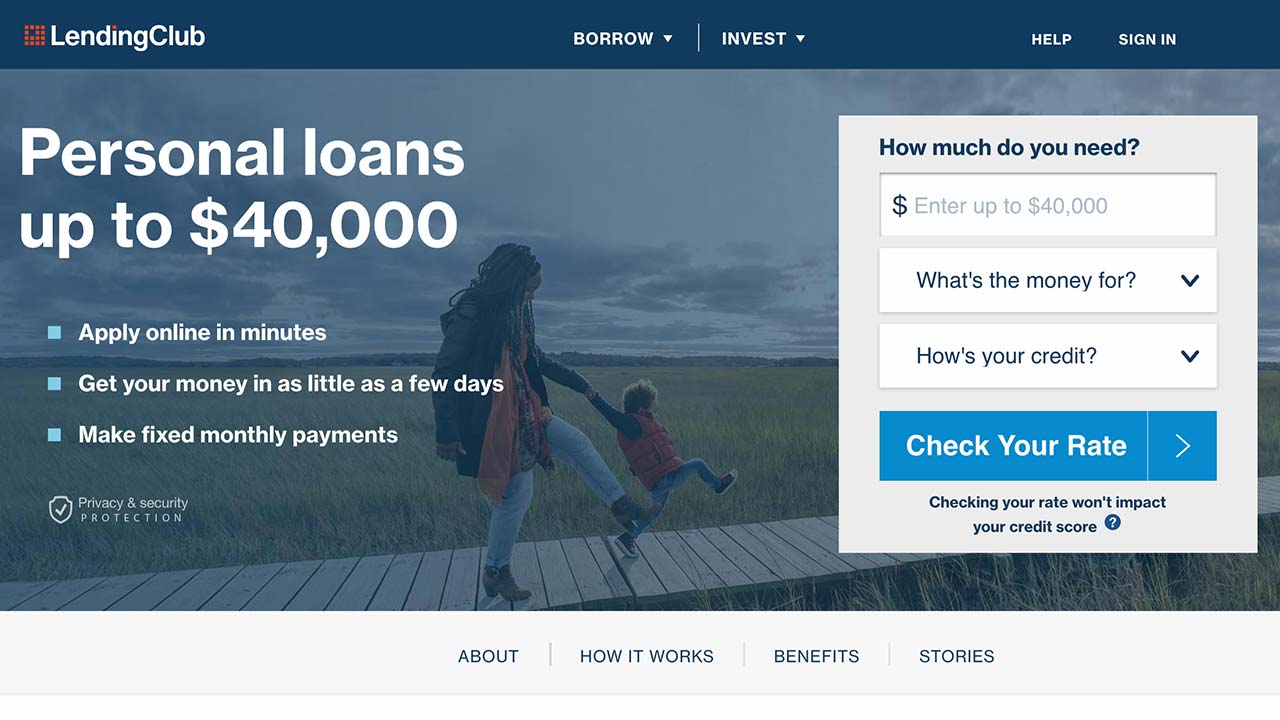

Unsecured loans

Unsecured loans keeps a less strenuous and you will shorter application process versus refinancing your home loan or getting an excellent HELOC. This really is ideal for people who have to pay recovery costs apparently soon, but do not have enough collateral in their house to acquire an excellent shielded mortgage. With respect to the financial, you might have to provide the plan for the building to help you get less interest rate. You may need to calculate any expenses, such as for example figuring exactly how much decorate you would like, to own a definite design package and you may funds.

Once the unsecured loans are unsecured, they usually have an interest rate that is greater than shielded loans. The interest rate can somewhat highest depending on your financial situation, for example when you yourself have a poor credit rating or reasonable money.

Playing cards

Borrowing from the bank of a charge card isn’t best if you are not in a position to pay it straight back quickly, which have credit cards which have extremely high rates. In case your do it yourself opportunity try short, for example they charging not totally all thousand bucks, a credit card might be a selection for you to without difficulty finance assembling your shed for a short span of energy. If you cannot pay it off soon and certainly will need to pay the loan off more a longer period of time, having fun with a charge card to finance home home improvements would not be for example smart. But not, handmade cards enjoys an excellent 21-go out sophistication months definition there is absolutely no desire for some weeks. People uses their cash straight back bank card to finance renovations while they watch for its 2nd paycheck.

Shop Capital Applications

Of numerous diy stores inside the Canada bring shop credit cards to have users. These playing cards may offer extra rewards, instance an extended go back several months, expanded warranties, and even special offers and you may promotions. Should you decide to the performing a smaller Diy venture and you want a means to funds your own recovery project, delivering a store charge card are going to be quick and easy.

The largest do-it-yourself store during the Canada are Household Depot, accompanied by Lowe’s. Home Depot, Lowe’s, Rona, and other national diy stores offer credit characteristics and you may money applications having people. Quite often, you don’t have to be an expert otherwise a professional specialist to be eligible for these types of software.

Most store financial support applications explore third-party organizations. Including, BMR Category, a devices shop organization in the eastern Canada, spends Desjardins Accord D funding. Castle Building Centres works closely with Flexiti having quick resource https://paydayloansconnecticut.com/saybrook-manor/. Timber Mart works together Fairstone Monetary.

Domestic Depot has the benefit of a credit rating cards, project financing card, and you may commercial borrowing qualities. Anybody can make an application for Domestic Depot’s credit cards and for a task financing. To possess commercial people, House Depot offers a professional revolving credit and you can a commercial membership. The fresh new revolving credit work instance credit cards, because commercial account performs eg a credit card, and therefore necessitates the harmony to-be repaid per month. Home Depot commercial professionals which have a professional Business Account and you can Professional Xtra Rewards may be eligible for no notice for 60 days on particular orders on Commercial Rotating Credit or Industrial Membership.

Leave a Reply