Documentation review is the most commonly used account reconciliation method. It involves calling up the account detail in the statements and reviewing the appropriateness of each transaction. The documentation method determines if the amount captured in the account matches the actual amount spent by the company. Reconciliation is an accounting procedure that compares two sets of records to check that the figures are correct and in agreement and confirms that accounts in a general ledger are consistent and complete. In double-entry accounting, each transaction is posted as both a debit and a credit. For instance, if you need bank reconciliation built into a complete general accounting solution, consider QuickBooks or Xero.

Business is Our Business

It helps identify discrepancies caused by outstanding checks, unrecorded deposits, bank fees, or other timing differences. QuickBooks Online is an all-in-one cloud-based accounting software that helps businesses manage different processes, including bank reconciliation, invoicing, project accounting and inventory management. It provides a systematic approach for reconciling bank accounts and has a unique feature called the Undeposited Funds account to streamline the reconciliation process further. Reconciling a bank statement is an important step to ensuring the accuracy of your financial data. To reconcile bank statements, carefully match transactions on the bank statement to the transactions in your accounting records.

Bank Reconciliation

Reconciliation confirms that the recorded sum leaving an account corresponds to the amount that’s been spent and that the two accounts are balanced at the end of the reporting period. Individuals should reconcile bank and credit card statements frequently to check for erroneous or fraudulent transactions. BlackLine is also a specialized bank reconciliation program and, just like ReconArt, it supports the entire financial close management cycle. It offers a wide range of features, including account reconciliation, task management and financial close automation.

Why Should You Reconcile Your Accounts?

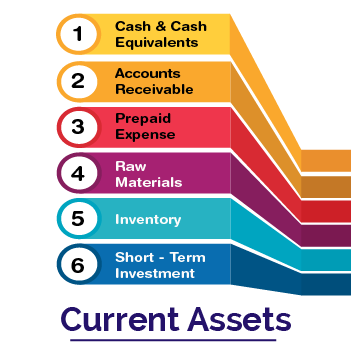

There are several steps involved in the account reconciliation process, depending on the accounts that you’re reconciling. Most companies have numerous assets including immovable what is a provision for income tax and how do you calculate it property, machinery, inventory, cash assets, and more. Over time, these assets can be sold or written off according to their stage in the lifecycle or due to depreciation.

What Are the Steps To Reconcile a Bank Statement?

For law firms, for example, one key type of business reconciliation is three-way reconciliation for trust accounts. In the following post, we’ll cover the crucial types of reconciliation for legal professionals and delve into the fundamentals of three-way reconciliation accounting. Plus, we’ll offer useful best practices for reconciliation in accounting for lawyers to help make the process easier, more effective, and more efficient. Before we get into the account reconciliation process, let’s back up and think about the who, what, and when of the reconciliation workflow. Perhaps the Excel spreadsheet you used to calculate the journal entry has a formula error. Some or all of these will happen at some point in the life of every business.

Mark Zuckerberg says WhatsApp has 100M monthly active users in the US

If your AR balance is $60,000, but you only have $40,000 in invoices that are due, your net profit will be overstated and you’ll be paying taxes on income that you’ll never receive. While very small businesses can use cash basis accounting, if you have employees or have depreciable assets, you’ll need to use accrual basis accounting. Accrual accounting is more complicated but provides a better insight into the financial health of your business. Cash accounting is the easiest way to manage your accounting, and provides a better picture of your cash flow, but is only a suitable method for very small businesses.

The objective of doing reconciliations to make sure that the internal cash register agrees with the bank statement. Once any differences have been identified and rectified, both internal and external records should be equal in order to demonstrate good financial health. It is possible to have certain transactions that have been recorded as paid in the internal cash register but that do not appear as paid in the bank statement. An example of such a transaction is a check that has been issued but has yet to be cleared by the bank. The primary objective of reconciliation is to identify and resolve any discrepancies between the two sets of records.

A company may issue a check and record the transaction as a cash deduction in the cash register, but it may take some time before the check is presented to the bank. In such an instance, the transaction does not appear in the bank statement until the check has been presented and accepted by the bank. Stripe offers a powerful reconciliation solution that streamlines the process for businesses.

Keeping your financial records in order is hugely important to the success of your business. Read the steps you should take when closing out your small business’ books for the end of the fiscal year. Manage your money and trust accounts with confidence, book your demo today.

Accounts like prepaid expenses, accrued revenues, accrued liabilities, and some receivables are reconciled by verifying the items that make up the balance. This may be done by comparing a spreadsheet calculation to the balance in the general ledger account. Once you have a solid starting point, look at the reconciling items in last period’s ending balances.

- As noted earlier, your state may have specific requirements for how often you must conduct three-way reconciliation—such as monthly or quarterly.

- In general, reconciling bank statements can help you identify any unusual transactions that might be caused by fraud or accounting errors.

- Stripe’s reconciliation process involves comparing your business’s internal records, such as invoices, with external records such as settlement files, payout files and bank statements.

- Adding to the challenge, sometimes an entry in the general ledger may correspond to two or more entries in a bank statement, or vice versa.

- Intuit QuickBooks is a financial accounting software program developed by Intuit.

- Accounts like prepaid expenses, accrued revenues, accrued liabilities, and some receivables are reconciled by verifying the items that make up the balance.

Account reconciliation is a crucial function in business accounting that helps address several fundamental objectives in the accounting process. Timing differences occur when the activity that is captured in the general ledger is not present in the supporting data or vice versa due to a difference in the timing in which the transaction is reported. For example, a company can estimate the amount of expected bad debts in the receivable account to see if it business ratios is close to the balance in the allowance for doubtful accounts. The expected bad debts are estimated based on the historical activity levels of the bad debts allowance. Businesses are generally advised to reconcile their accounts at least monthly, but they can do so as often as they wish. Businesses that follow a risk-based approach to reconciliation will reconcile certain accounts more frequently than others, based on their greater likelihood of error.

Bank errors are infrequent, but the company should contact the bank immediately to report the errors. The correction will appear in the future bank statement, but an adjustment is required in the current period’s bank reconciliation to reconcile the discrepancy. Reconciling an account is an accounting process that is used to ensure that the transactions in a company’s financial records are consistent with independent third party reports.

Once the individual client ledgers and the firm’s trust account ledger are aligned, you can then reconcile the client ledgers and trust account ledgers with your trust bank account statement. Once you have access to all the necessary records, you need to reconcile, or compare, the internal examples of fixed assets trust account’s ledger to individual client ledgers. How often should you conduct the three-way reconciliation accounting process? As noted earlier, your state may have specific requirements for how often you must conduct three-way reconciliation—such as monthly or quarterly.

During reconciliation, you should compare the transactions recorded in an internal record-keeping account against an external monthly statement from sources such as banks and credit card companies. The balances between the two records must agree with each other, and any discrepancies should be explained in the account reconciliation statement. The best bank reconciliation software should allow you to match your bank statements with the transactions in your bank register easily. Additionally, it must offer time-saving features, such as automated workflows, automatic transaction import and accounting integration if needed.

Incorporating these strategies into your reconciliation process not only simplifies the task but also enhances the accuracy and efficiency of your financial management. Integration with accounting software like NetSuite, QuickBooks, Xero, or Sage, especially when paired with Ramp, can be a significant step toward streamlining your financial operations. Thirdly, account reconciliation is vital to ensure the validity and accuracy of financial statements. Individual transactions are the building blocks of financial statements, and it is essential to verify all transactions before relying on them to produce the statements. For example, while performing an account reconciliation for a cash account, it may be noted that the general ledger balance is $249,000. Still, the supporting documentation (i.e., a bank statement) says the bank account has a balance of $249,900.

Leave a Reply